OUR CONTEXT

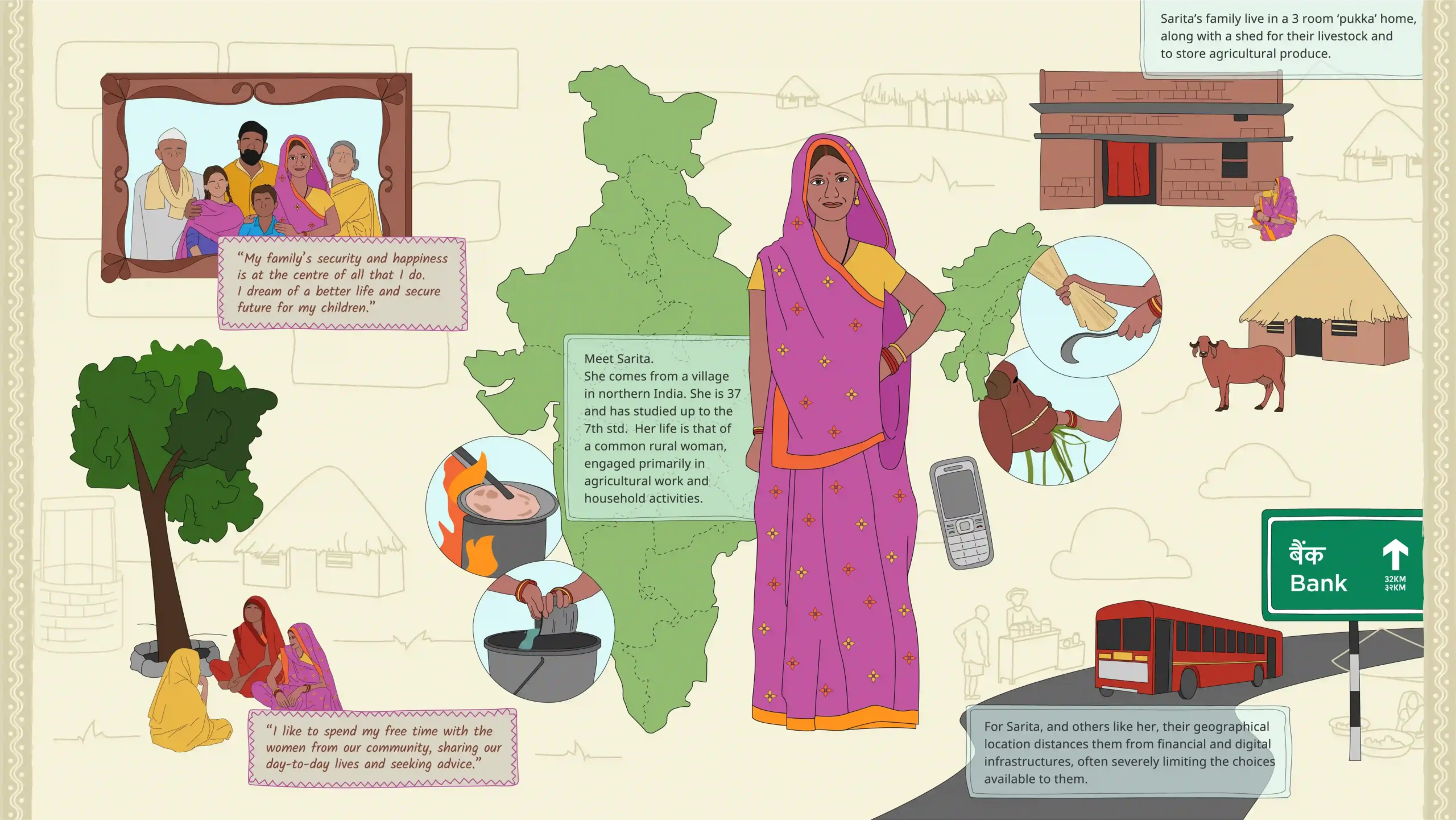

Ramshila Dangi, a 32 year old residing in Bahadurpura village, Madhya Pradesh, embodies the challenges faced by many in rural India when it comes to accessing formal financial services. Living in a community with low literacy rates and deeply entrenched traditional norms, Ramshila grapples with social constraints that limit her mobility and opportunity to make decisions. Due to her family’s lack of trust in financial institutions, Ramshila is hesitant and doesn’t understand much about financial products.

Adding to her challenges are the barriers of geography and location. The nearest bank is situated nearly 30 km away from her village, making the journey time-consuming and costly. The absence of reliable transportation options and poor infrastructure compounds the issue, making it difficult for Ramshila to travel alone. Her family owns a single smartphone that usually stays with her husband or children. This, along with inconsistent connectivity in the region, restricts her ability to access the internet and use online services. This combination of social, geographical, and infrastructural barriers holds Ramshila and countless others in rural India back from easily and confidently accessing essential financial services.

OUR CONTEXT

Ramshila Dangi, a 32-year-old residing in Bahadurpura village, Madhya Pradesh, embodies the challenges faced by many in rural India when it comes to accessing formal financial services. Living in a community with low literacy rates and deeply entrenched traditional norms, Ramshila grapples with social constraints that limit her mobility and opportunity to make decisions. Due to her family’s lack of trust in financial institutions, Ramshila is hesitant and doesn’t understand much about financial products.

Adding to her challenges are the barriers of geography and location. The nearest bank is situated nearly 30 km away from her village, making the journey time-consuming and costly. The absence of reliable transportation options and poor infrastructure compounds the issue, making it difficult for Ramshila to travel alone. Her family owns a single smartphone that usually stays with her husband or children. This, along with inconsistent connectivity in the region, restricts her ability to access the internet and use online services. This combination of social, geographical, and infrastructural barriers holds Ramshila and countless others in rural India back from easily and confidently accessing essential financial services.

BRIDGING FINANCIAL BARRIERS IN RURAL INDIA

Swadhaar’s work focuses primarily on rural India, where a significant portion of the country’s workforce lives, works, and aspires to a better future. Approximately 70% of these rural households rely primarily on agriculture for their livelihoods, and a staggering 82% own less than one hectare of cultivable land. During the lean months, many men migrate to nearby towns and cities in search of work, leaving their families behind.

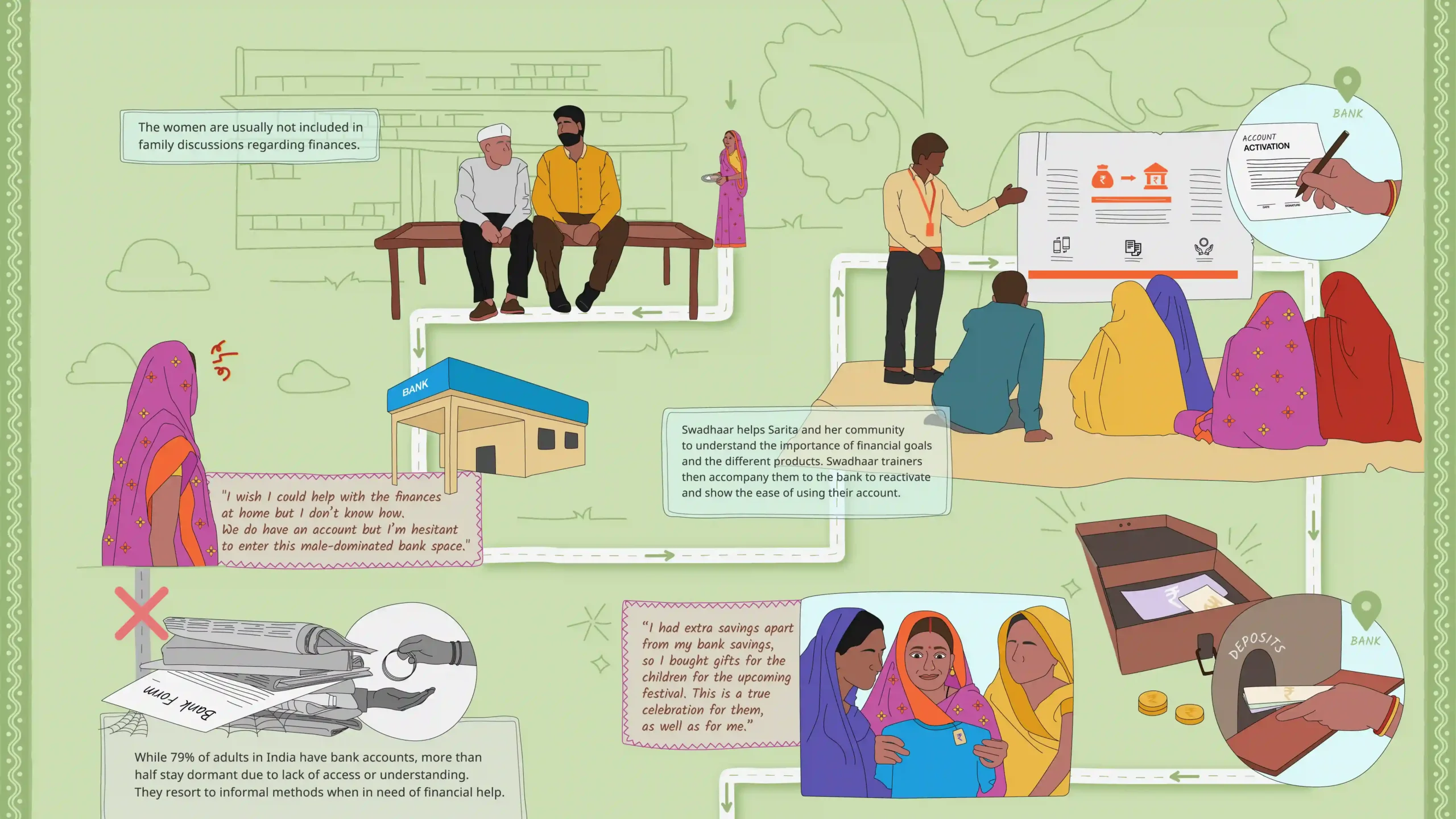

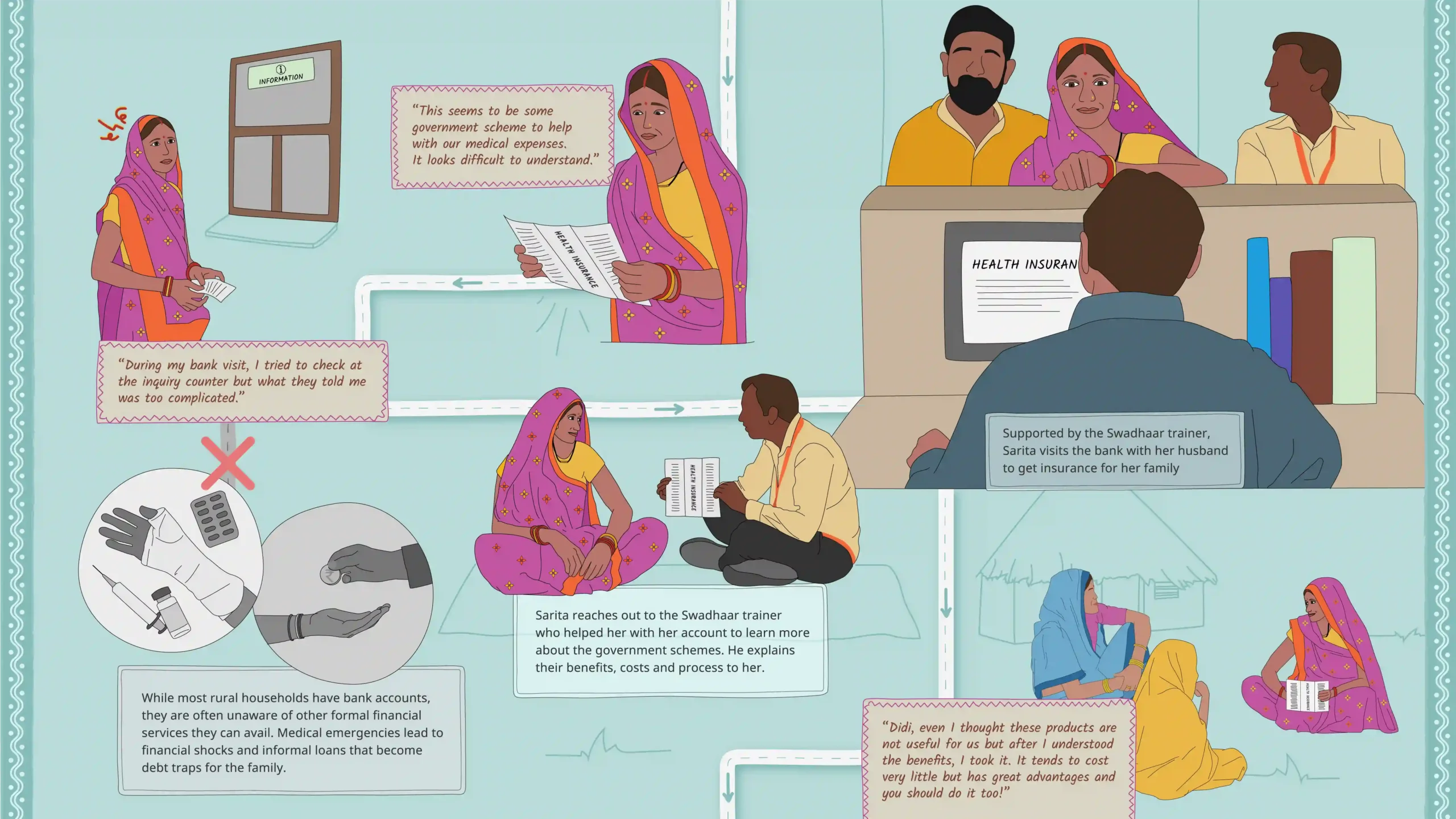

Families in rural India grapple with various vulnerabilities. Their limited access to financial services exacerbates these challenges, impeding their ability to break free from the cycle of debt and poverty. Women in these families, in particular, bear a disproportionate burden as they contend with societal and economic pressures, including limited educational opportunities, inadequate healthcare, restricted mobility, and gender-based discrimination.

UNDERSTANDING FINANCIAL DISPARITIES

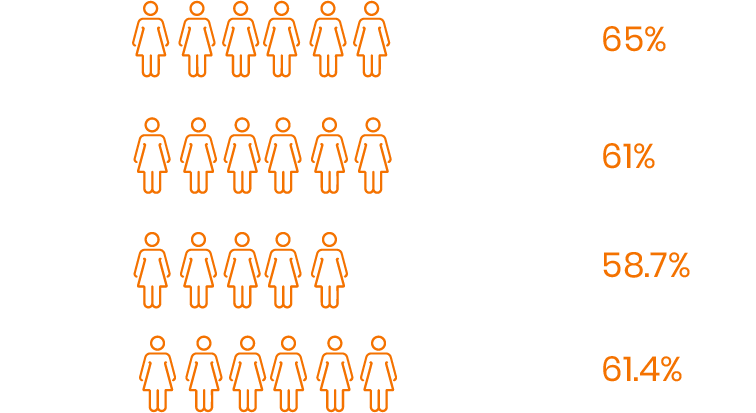

The Global Findex Database 2021 found that only 38% of rural women in India have a basic understanding of financial concepts. Rural women are also less likely than their urban counterparts to have access to financial services and products: 77% of urban women have bank accounts compared to 58% of rural women. Additionally, just 28% of rural women have ever borrowed money from formal financial institutions, compared to 48% of urban women.

These low levels of financial literacy and access to financial services make it difficult for rural households to make informed financial decisions. Informal credit at high-interest rates is often the only easily accesible financial tool, leading to debt traps and cycles of financial insecurity.

Click the numbers above to learn more about the access India’s lower-middle income group has to financial products and digital banking. (Source: Global Findex Database 2021)

UNDERSTANDING FINANCIAL DISPARITIES

The Global Findex Database 2021 found that only 38% of rural women in India have a basic understanding of financial concepts. Rural women are also less likely than their urban counterparts to have access to financial services and products: 77% of urban women have bank accounts compared to 58% of rural women. Additionally, just 28% of rural women have ever borrowed money from formal financial institutions, compared to 48% of urban women.

These low levels of financial literacy and access to financial services make it difficult for rural households to make informed financial decisions. Informal credit at high-interest rates is often the only easily accesible financial tool, leading to debt traps and cycles of financial insecurity.

FINACT projects are conducted through the Live Labs at 10 selected locations near Swadhaar’s operational networks with communities and women who are representative of the typical Swadhaar customer.

Click on the highlighted states to see where Swadhaar operates across India.

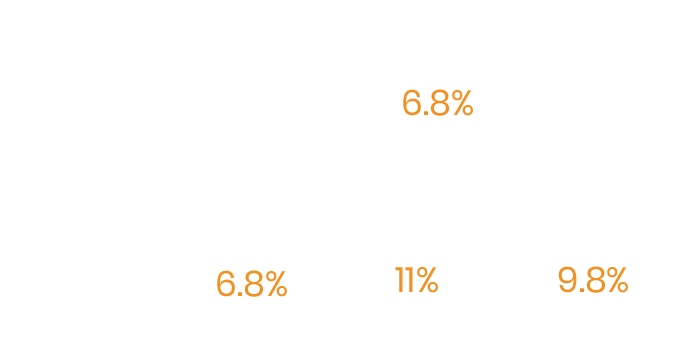

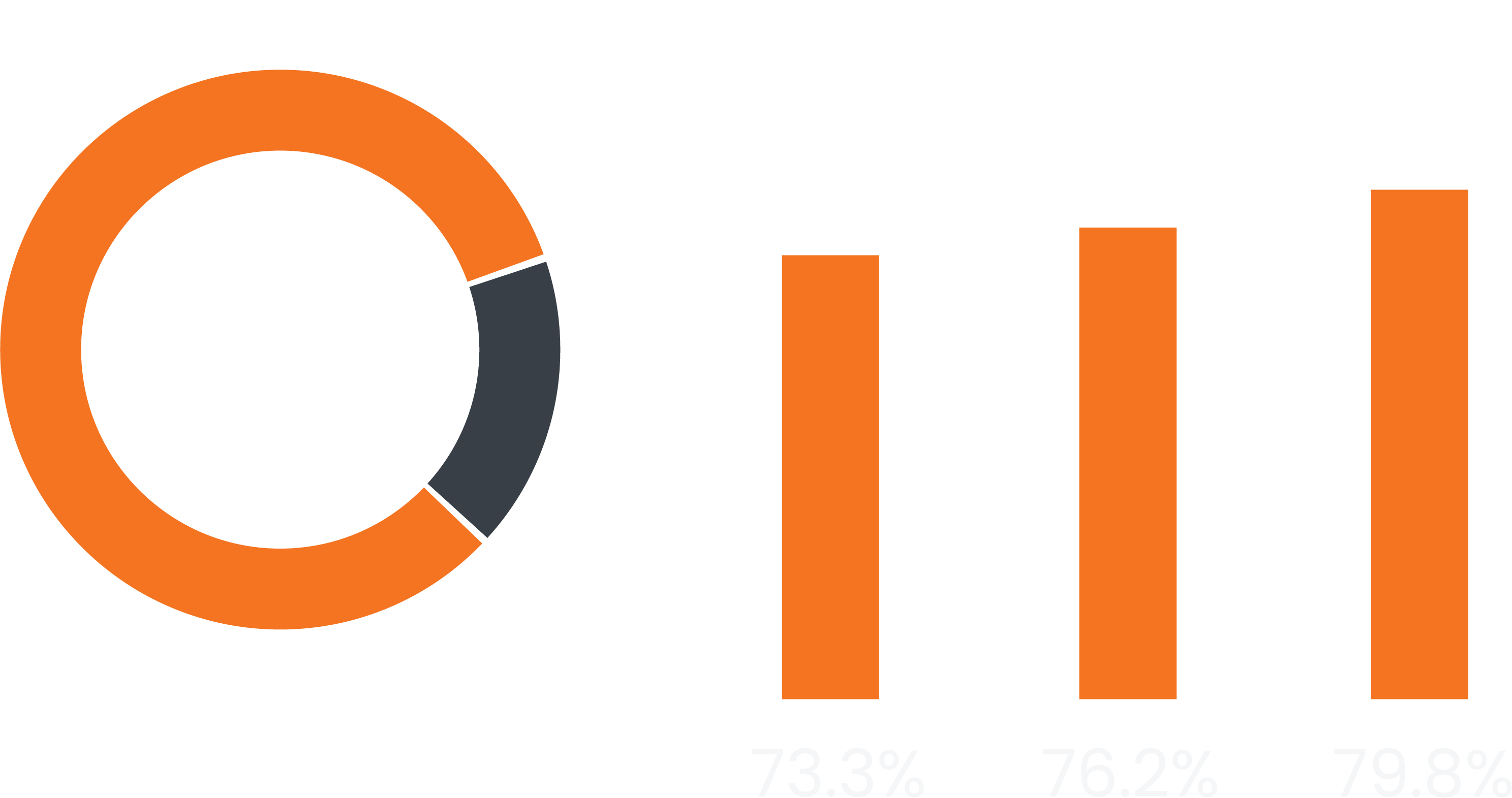

While the statistics for India are quite startling, rural populations in the states we serve are especially underserved. Have a look below at the on-ground realities in Madhya Pradesh, Bihar, and Jharkhand, in comparison to the rest of India.

- Rural Population

- Rural Female Literacy

- Early Marriage and Teenage Pregnancies

- Financial Inclusion – Savings Accounts

Rural Population

Rural Female Literacy

Early Marriage and Teenage Pregnancies

Financial Inclusion – Savings Accounts

Who is our typical Rural Client?

Through Financial Literacy training and capability building, Swadhaar aims to empower rural Indian households with the necessary tools to manage their finances, access financial resources, and make informed investments. Our efforts are directed towards unlocking the full potential of these communities, focused on financial resilience as key to helping families move out of the cycle of poverty and vulnerability.

Through Sarita’s life and journey below, find out more about the hopes and dreams of our clients, the barriers and challenges that they face on a daily basis, and how they take their first steps towards financial agency through Swadhaar’s interventions.